State Bank of India (SBI) which is the largest public lender in India hiked the interest rates on fixed deposits (FDs) on Wednesday, 28th November 2018, with the maturity periods varying from one to two years. The recent modifications in fixed deposits interest rate comes after other major financial institution such as ICICI Bank and HDFC Bank raised rates.

SBI increases interest rates for fixed deposits

According to the statement by the SBI on its website which stated that SBI Fixed Deposits interest rates have been raised by 0.05 to 0.10 per cent. A distinct base point agrees to 0.01 per cent. In its further statement in their official website stated that the change in Fixed Deposits interest rates will be valid to all sums below Rs 1 crore from today onwards.

People usually invest in Fixed Deposits as it is safer, particularly for those accessible by public sector banks including Punjab National Bank (PNB), State Bank of India and many more. Financial advisers recommend individuals to invest in fixed deposit because the investment in fixed deposits offers a fixed rate of interest on their deposits often higher than the interest rates offered to the individuals of the regular savings accounts.

State Bank of India (SBI) FDs: New Interest Rates

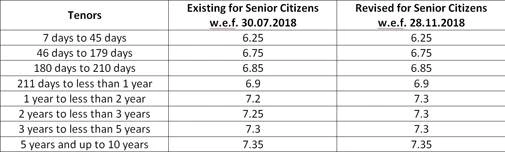

After the latest modification in FDs interest rates, the SBI is now offering 6.80 per cent interest rates with the maturity period of one or two years. Comparing to the previous rate the rates are raised to 0.1 per cent as it was at 6.7 per cent previously. The SBI FD interest rates has also increased up to 7.30 per cent for the senior citizen with the maturity period of one or two years.

Everyone should note that SBI has not changed interest rates of some FDs with other maturity period. Not only SBI but also other banks whether it is private or public is offering raise in FDs with different maturity period varying from seven days to a span.

Here is the information of all the details of FDs interest rates along with their maturity period:

- The interest rates for the maturity period of 7 days to 45 days is same as previous rates i.e. 5.75

- The interest rates for the maturity period of 46 days to 179 days is same as previous rates i.e. 6.25

- The interest rates for the maturity period of 180 days to 200 days is same as previous rates i.e. 6.35

- The interest rates for the maturity period of 211 days to less than 1 year is same as previous rates i.e. 6.40

- The interest rates for the maturity period of 1 year to less than 2 years is changed from the previous rates i.e. 6.70 to 6.80 (new rates)

- The interest rates for the maturity period of 2 years to less than 3 years is changed from the previous rates i.e. 6.75 to 6.80 (new rates)

- The interest rates for the maturity period of 3 years to less than five years is same as previous rates i.e. 6.80

- The interest rates for the maturity period of 5 years to 10 years is same as previous rates i.e. 6.85

The bank is also offering 50 basis points or an extra 0.5 per cent interest rate for senior citizens with fixed deposits across all its maturity period. Also, the individuals who have fixed deposits with a least maturity period of five years are also entitled for tax benefits under the Section 80C of the Income Tax Act.

Leave a Reply