I still remember my mom’s shopping advice— buy only those things which can last for long.” So, when I purchased a motorcycle last year, I also opted for a long-term two-wheeler insurance policy. After all, the policy covers my bike for three years in one go. Along with this, other benefits which my long-term bike insurance offers are:

- Convenience: For people like me who are bad in remembering dates, long-term policies come as a blessing in disguise. It is cumbersome to keep a track of the annual renewal dates, particularly, when someone holds more than one policy. Even if someone remembers the date, he/she might fail to renew the policy due to paucity of time. A few years ago, I forgot to renew my bike insurance because I was busy in my office. However, these things can be taken care of by opting for a long-term two-wheeler insurance policy. It offers a wonderful way of keeping your ride insured without going through the annual policy renewal ordeal every time.

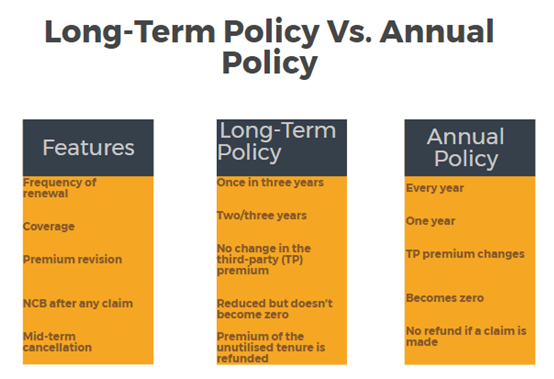

- Save money: Thanks to my long-term policy, I make a huge saving close to 15%-25% on the premium as compared to an annual policy. This is because the insurance watchdog, IRDAI revises third party premium rates every year. For the financial year 2016-17, the IRDAI revised the third party premium rates for two-wheelers of engine capacity 75-150 cc to Rs 619 from Rs 538. As I have a long-term policy, I don’t need to worry about any annual premium hike.Further, as most of the insurance companies save money on administrative and policy-issuing costs, in the case of long-term bike insurance policies the same is passed on to policyholders in the form of cheaper premium rates.

- Protection for a longer time: As the long-term bike insurance is valid for a longer duration, say two or three years, one doesn’t have to undergo the trouble of renewing the policy every year. Moreover, I don’t need to undergo vehicle inspection every year on renewal. My comprehensive bike insurance offers all the benefits, such as coverage for all the losses, repairs and damages caused to a third-party as well as to my vehicle.

- Higher No Claim Bonus (NCB): Post-completion of the policy year, many insurance companies offer No Claim Bonus (NCB) on renewal if a no claim is made in the previous year. Under the single-year policy, you lose NCB even if a single claim is made. However, in case of long-term policies, insurers offer NCB even if a claim is made, subject to the number of claims made during the policy tenure.

- Safety from non-renewal related risks: In case of non-renewal of a policy, the insured is exposed to various types of risks. For instance, in case the vehicle meets with an accident, all the losses/damages have to be paid by the vehicle owner itself. However, this can be easily avoided if you go for a long-term two-wheeler insurance policy. The insurer will cover losses/damages in case of any mishappening.

- Easy to cancel the policy: You might be thinking that if you opt for a long-term policy, you would have to stick to it even if you don’t like a policy. However, it is not true, just like a single year policy, you can opt for the cancellation of insurance cover or opt for another policy at the time of renewal. As per the norms, the insurance company will refund the unutilised premium amount. Nevertheless, one should cancel the old policy only after buying the new one.

You can’t fool mom, so I am happy that I listened to my mother and opted for a long-term two-wheeler insurance policy which not only insures my journey but also saves my money. Indeed, I am free from endless and daunting loops of vehicle inspection and unnecessary paperwork that are feared by all. Instead of forgetting renewal and then getting into trouble under uncalled events, a single premium installment under long-term two-wheeler insurance is enough to make me worry-free.

Did you just say, “Mothers have all the tricks to save money and ease your tensions?”

Leave a Reply