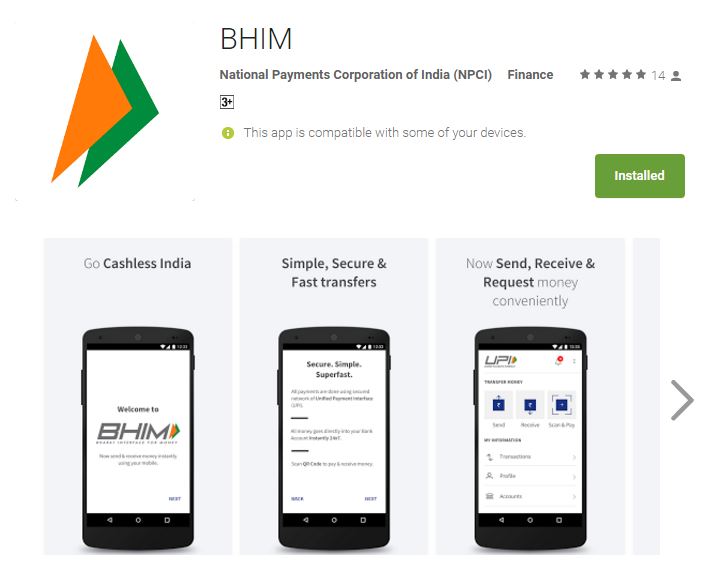

Prime Minister ‘Narendra Modi’ today launched UPI-based mobile payment application called BHIM “Bharat Interface for Money” a rebranded rendition of UPI (Unified Payment Interface) and USSD (Unstructured Supplementary Service Data), at the Digi Dhan Mela occasion in Talkatora stadium in New Delhi.

“The application can be downloaded from Android application store“.

According to the source report, PM Narendra Modi said at the moment, Be it a smartphone or feature phone of Rs 1,000-1,200, BHIM application can be utilized. There is no need Internet network.

One just needs a thumb. In the past, an unskilled was called ‘angutha chchap’. Presently, time has changed. Your thumb is your bank now. It has turned into your personality now.

Facts: BHIM Application and PM Modi Announces World Will Google For It

1. The BHIM application is being enhanced so that in time, just your thumb will be expected to make a payment, said the PM Modi, including that, you, will in the end not be reliant on the web, on cell phones, your thumb will be your bank.

2. As such, there has been no declaration of whether the money limitations at ATMs and withdrawals from banks that were presented after demonetisation will stay set up in the new year.

3. On November 8, PM Modi’s stun declaration rendered 86 for every penny of India’s coin void, giving individuals until today to swap their old 500 rupee and 1,000-rupee bills for new ones.

4. The PM has been generally hailed for his ambush on assessment avoidance, however, long lines outside banks, a money crunch, and strategy flip-flops have prompted to a deliberate assault from the restriction.

5. As the right around two-month window attracts to a nearby, serpentine lines outside banks have weakened however a solitary 2,000 rupee note is still all that most ATMs apportion to clients.

6. The dangerous bet is relied upon to affect the race in Uttar Pradesh, which is required to be held in February. Many top industrialists and budgetary specialists have lauded the PM’s call to move towards an advanced economy.

7. Until March 31, old notes can be kept with the Reserve Bank of India, however, today is the last chance to do as such at different banks. After the March due to date, there will be a base 10,000 rupees punishment for holding old notes.

8. Financial experts anticipate that the economy will profit in the long haul because of an expansion in expense incomes yet just once there is an ample supply of those tricky new notes available for use.

Leave a Reply